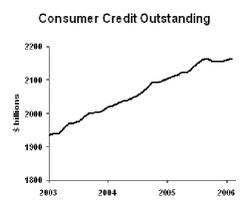

Consumers have leveled off their credit:

This series does not include real estate loans; it counts credit cards, car loans, etc. It appears that consumers are trying to limit their debt (good idea), helped perhaps by higher minimum payment schedules on credit cards. This trend is likely to continue as short-term interest rates rise, pushing up car loan costs as well as the interest rates on many credit cards.

Business Implication: It will be harder to sell interest-sensitive consumer goods this year, including cars, boats, home spas, etc.