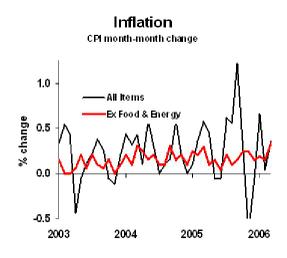

OK, today’s CPI report pretty much guarantees the Fed will hike rates the end of this month. The rise in the "core rate" (the CPI excluding food and energy) is most worrisome to the Fed. That’s the red line on our chart.

My fellow data hounds are pointing out that housing costs are giving a big and misleading push to the CPI. "Owner’s equivalent rent" is how the statisticians gauge inflation in the cost of housing. If you own a home, they assume that you as a landlord rent the house to yourself as a tenant. They estimate rents, based on comparable rental homes, and that’s for the housing component of the CPI. Rents are now rising sharply, because they had been artificially depressed when every credit-worthy family in America bought a house or a condo. There’s really no good way to handle housing costs in the CPI; looking at the price of houses confuses investment prices with living costs. In any event, the Fed may be over-reacting if it bases rate hikes on the owner’s equivalent rent increases.

Further problem for the Fed: time lags. We all know that inflation takes a while to bring down. It’s possible that the past two year’s interest rate hikes are doing the job, but we have to wait a bit longer to see their effect. If that’s the case, then further rate hikes are a mistake.

WWBD? What would Bill do? I think I’d pause this meeting, but it’s not a clear issue. I’d been leaning 60/40 to pause; not utterly stupid to hike rates. How’s that for a clear answer?

Business Strategy Implications: I’m raising my own estimate of the chances of a recession in the coming two years. The possibility of a Fed policy mistake is rising, simply because the data signals are getting harder to interpret, due to both housing and oil costs. So if you have not done your contingency planning for an economic slowdown, start today. Call me if you want some help on it. That’s one of my favorite consulting topics.