Check out the Wall Street Journal article about steel (if you have the on-line subscription, which I recommend highly). Here’s the lead:

Inventories of steel have been piling up in customer warehouses in the U.S., creating worries of a glut and downward pressure on prices.

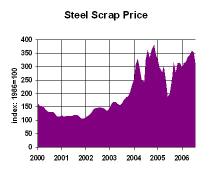

Let’s take a look at prices. Scrap steel is a good indicator of steel value.

The price run-up has brought new supply on line world-wide. Strong U.S. prices have brought imported steel into the country. Now, there’s plenty. That’s pretty much the story, eventually, for any commodity. The process is described well in a recent IMF report that I posted about.

Of course, recent weakness in the automobile sector plays second whammy to the supply increase’s first whammy. At this point, expect weakness in steel prices over the coming year.

Business Strategy Implications: Producers of commodities have to be very careful about expanding output when price hikes have "matured." Too much supply usually comes on line. For consumers of commodities, don’t get overwhelmed by price hikes, don’t talk yourself into locking in supply at a rich price, because the prices always come back down.