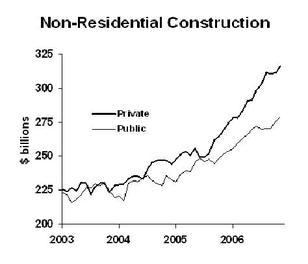

Nonresidential construction resumed its upward trend in November, with private sector building outpacing public sector.

12-month gains in private nonresidential construction totaled nearly 15 percent, with especially strong increases in lodging, office, health care, amusement, communications and conservation sectors. Manufacturing building construction was up a pretty decent 11.3 percent.

The Wall Street Journal reports today (subscription required) that the outlook for investment real estate is still positive. The article emphasizes that market participants are not as positive as they were last year, but my takeaway is that they are still in an upbeat mood. Operating earnings are improving, thanks to rising occupancy rates and higher rents with fewer tenant concessions.

The big conundrum in my mind is whether the investor interest in commercial real estate will continue. Argument for optimism: large institutional investors, such as pension funds and university endowments, are increasing their allocation to real estate. There’s sound reason for this. If you run through the asset class returns and correlations, an efficient portfolio needs more real estate than most institutional portfolios have. So increasing the allocation to real estate investments is just good portfolio management.

Argument for pessimism: the portfolio theory calculations are just a smokescreen for chasing last year’s top sector. When returns start to drop, institutional investors will try to cut their allocation to real estate. Then they will learn something that they know in theory, but not from their personal experience: real estate is illiquid. That could lead to sales at below-market prices due to impatience.

My conclusion: I like non-residential real estate long-term, but I think it’s currently overbought, at serious risk of a downturn. In fact, I’ve liquidated what had been a large REIT position in my own portfolio. (I’m currently kicking myself for having done this too early.)