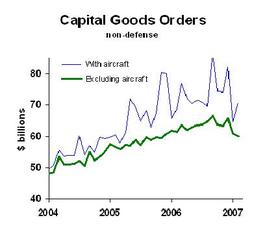

Business orders for capital equipment rose counting aircraft. But the non-aircraft sector was down:

I separate out orders for aircraft for two reasons. First they are very volatile, as the chart shows, so they don’t always describe current economic conditions accurately. Second, the major manufacturer, Boeing, and its subcontractors are now producing full bore. Additional orders won’t add many jobs, and a drop in their orders won’t lead to layoffs for quite some time.

So I focus on non-aircraft business capital goods orders, and I’m nervous. I expressed that concern a few months ago, writing: "If business capital spending falters at the same time that housing is cratering, the economy could slow down much more than I’m anticipating."

Well, it looks like business capital spending is, indeed, faltering. At the end of this week, when we get revised GDP data, I’ll be updating my economic forecast. I expect my outlook will be a bit less optimistic, but let me run the numbers before I commit myself.

Business Planning: Companies in the capital goods sector should be in full-blown caution mode: watch inventories like a hawk, don’t you dare ease up on your trade credit standards, reconsider any major capital expansions, and be very cautious about hiring. If you haven’t done your economic contingency planning, get started now.

Investment Strategy: I don’t recommend swinging your investments around based on month-to-month economic data, but … I wouldn’t add to my holdings of either heavy equipment manufacturers or tech companies in the B2B equipment space. If overweighted in these sectors, time to rebalance.