Many economists are shading their forecasts downward, according to an article in today’s Wall Street Journal (subscription required). The median forecast for the current quarter is 2.3 percent. (I brought my forecast down to 2.5 percent, but the truth is that you cannot tell the difference between 2.5 and 2.3. No business or household will have a clue what the last decimal place is.)

Key to the revision is the weakness in business capital spending, which I’ve commented on recently. Housing construction is weak, but we’ve known that for a while.

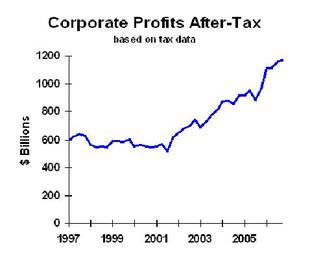

Yesterday’s report on corporate profits suggests that companies still have the means for capital spending. Note, however, that although the level of profits is still quite high, there was hardly any growth last quarter.

Business Strategy and Planning: A downward revision of the consensus forecast is bad news, even if the new forecast is tolerable. Honestly, we economists don’t always have perfect economic outlooks. The downward revision is seldom a good sign. So dial up the caution level.

Investment Advice: If you are not going to take my basic advice (get a good asset allocation and ignore the news), be cautious about equity investments right now. The downward revision to growth estimates is negative, and I’m expecting long term interest rates to rise. Out of this a bull market is unlikely. That does not mean the market will crater; I’d guess a low appreciation for this year, which is decidedly better than no appreciation at all. But I can clearly see downside risks–if you can’t see them, too, get your eyes checked.