A recent post about real estate has prompted a comment, in which the advantages of real estate were listed. Real estate certainly has strengths, but diversification does, too.

Basic concepts: return of an asset is the dividends or current earnings, plus the price appreciation. Risk the the possibility that the return will not match expectations. Risk is usually measured by the standard deviation of returns. Finally, diversification is simply having more than one asset in a portfolio.

Here are some numbers for the last three decades of the 20th century:

Stocks: 10.71% average return, risk = 20.24%

Real estate: 10.46% return, risk = 17.76%

Correlation: 0.539

(You’ll get slightly different estimates if you calculate averages using different indexes or a different time period. However, you’ll still be close to these numbers.)

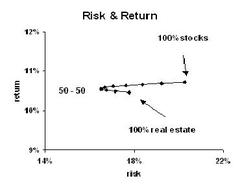

The really cool thing about diversification is that it reduces risk, often with little or no reduction in return. That’s because sometimes–not always, but sometimes–one asset goes up when the other goes down. Here’s what risk and return look like for stocks and real estate at differing levels of diversification.

The chart shows that returns (on the vertical axis) are not much affected by asset allocation between stocks and real estate, but risk is heavily impacted.

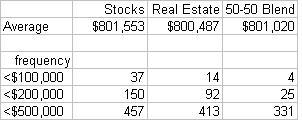

What does this mean in real life? Let’s say you have $100,000 and you are investing with a 20-year time horizon. I consider three alternatives: stocks, real estate, or a 50-50 blend of the two. I used the average returns above, and pulled random numbers that match the standard deviation of the various alternatives. I simulated 1000 possible outcomes. (That’s one random number for each year, for 20 years, repeated 1000 times for each alternative.)

Here are the basic results:

On average, investors ended up around $800,000, not bad after starting with only $100,000. Returns weren’t much different among the three alternatives. But look at the next three lines, which show how often the total portfolio was less than certain amounts after 20 years. The stock investor ended up with less than he started with 37 out of 1000 trials (or 3.7 % of the time). The diversified investor has minimal risk, much lower than either undiversified investor. Diversification protects against downside risk. (It also "protects" against upside risk; the highest returns went to undiversified stock market investors. That’s where to go if you’re swinging for the fences.)

In this example, I assume that the stock market portfolio is diversified, as is the real estate. If you own just a few stocks or just a few pieces of real estate, then you have much greater risk.

Investment conclusion: real estate is fine, in moderation. Blending both stock and real estate, however, provides great risk reduction. There is still risk, but much less for the diversified investor.