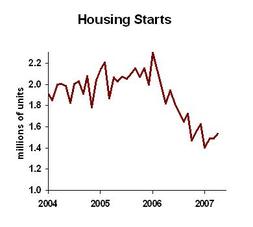

The headlines say housing construction had a surprising increase last month ("Housing Starts Unexpectedly Rise …", Wall Street Journal), but the sector is still lousy.

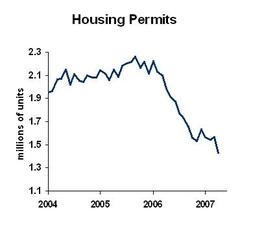

This blip does not say that the trend is anything but down. The data often sawtooth from month to month, based on weather and sheer random variation. In case you’re tempted to think that this is the beginning of the rebound, look at permits, which point to future starts:

Nothing but bad news on its way in the residential construction market.

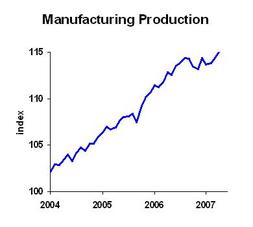

But the manufacturing data (from the Federal Reserve’s Industrial Production report) is encouraging:

Looks like we had a mini-cycle in the manufacturing sector, which is now about over. If so, then recession risk can be adjusted downward.

The economy’s biggest risk is spillover from housing weakness to consumer spending. A secondary risk emerged six months ago: weak capital spending. But orders for new equipment have rebounded, helping manufacturing production, so this risk is diminished. We still have the consumer risk, but every month that we avoid that bullet, the odds look better and better.

Business planning implications: Keep planning on economic expansion (unless you are in the residential construction food chain). Do some upside contingency planning: are you ready for more orders? (Upside contingency planning is discussed in Chapter 7 of Businomics.)