Long-term interest rates are rising, having risen one-half percentage point in the last month. Given my forecast of at least another full percentage point increase in the next year, I asked, what will happen to stock prices as long-term rates are rising?

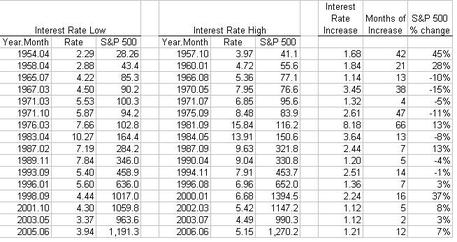

I grabbed monthly data since the 1950s and identified every period in which the yield on the 10-year Treasury bond increased by at least one percentage point. (You’d get very slightly different results if you looked at daily data, and you’d work a lot harder.) Here’s the summary table:

The results split fairly evenly: 7 instances of stock market decline, 9 of stock market increase. However, magnitudes are important, so I calculated the average change in stock prices of all these periods. (It’s really a compound growth rate for you quants.) Stocks rose at an annual rate of three percent per year during periods of rising long-term interest rates. This compares to the long-run average of stocks, which is to rise about eight percent per year. So I expect sub-par stock market performance for a while, but not a disaster.

What to do with your wealth? Take the three percent average stock return and throw in two points for dividend yield and your stock portfolio is doing about as well as cash. Are there any good alternatives? Bonds certainly decline when long rates are rising. Real estate, too, seldom has good appreciation during rising interest rates. Go overseas? I suspect this will be a global phenomenon.

My advice: stick with a good, long-term asset allocation. If you’re overweighted in stocks, rebalance (especially if you can do it without harsh tax consequences). If you’re slightly underweighted in stocks, sit tight. If you are appropriately weighted in stocks, but nervous, pour a jigger of gin over ice, add three drops of vermouth, and think about summer.