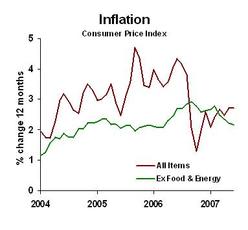

Inflation wasn’t too bad in today’s report. It’s still a bit higher than comfortable to the Fed, but the trend is looking just an itsy-bit better (forgive the technical jargon):

Don’t expect the Fed to easy anytime soon with inflation where it is.

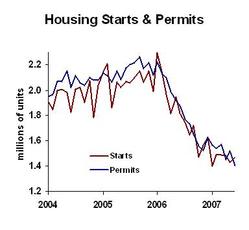

Housing news also came out. The Wall Street Journal’s sub-head announced, "Housing Starts Jump," which is yet another example that headline writers are the lamest intellects in all of journalism–which is really saying something. Let’s look at the chart:

Follow the red line, housing starts, to the bottom right area on the chart. Find the last little wiggle in the red line. That is housing starts jumping. Not exactly an Olympic class jump; wouldn’t even get over the average mud puddle. And permits for new starts continued to decline.

The gain in starts was in multi-family units, reflecting some improvement in the fortunes of apartment owners. They are starting to get tenants again, helped by high home prices and the collapse of the sub-prime mortgage market. Single family starts were actually down last month, as they should be.

Business Planning Implications: Expect no change in short-term interest rates through the rest of 2007. Businesses in the housing construction supply chain must refrain from interpreting any information as good news. If you see something that looks like good news, you are in denial. There is no good news. Won’t be any coming out any time soon. Sorry, but the truth is the truth.