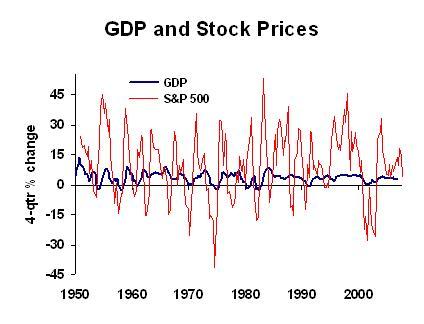

When two things have different names, they are usually different things. Take a look at stock prices and the economy:

The first thing you see is that changes in stock prices are far, far greater than changes in the economy. There are two good reasons for this. First, corporate earnings are more volatile than the economy. If sales drop 10 percent, many companies will see profits fall 100 percent. Their variable costs usually don’t fall in proportion to the sales drop, and their fixed costs don’t fall at all. So fully rational investors should change their valuations of stock prices more than proportionately to changes in their expectations for the economy. Second, not all investors are rational. (Surprise! You didn’t know that?) They often overreact to current news, causing stock market movements to swing much wider than economic trends. There’s also a herd effect that’s at work. You are getting nervous; not sure what to do; then you see everyone else selling like mad. You sell. It may not be rational, but it’s more comfortable to follow the crowd. This might be a good time to reread Keynes’s General Theory.

What is the economic outlook, given the huge sell-off? Here’s a summary of the key points from Chapter 11 of Businomics:

- The economy impacts the stock market

- The stock market tends to be a leading indicator of the economy, but not consistently or with great precision

- The stock market can affect the economy, but only to a small extent

There’s also a discussion for corporate CFOs about how to react to swings in your company’s stock price.

For those of you involved in business planning, my 2008 economic forecast has slow growth this year, but no recession. It’s certainly time to do some contingency planning, as I discussed here. You might also want to check out Chapter 7 of Businomics, which has a checklist for managing in a downturn.