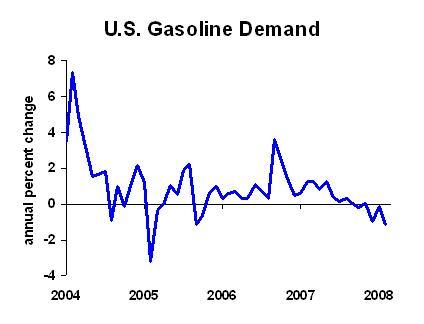

We’re using less gasoline:

The most important thing to know about energy demand is that time lags are long. When prices rise, we tend to keep doing what we’ve been doing. We tend to view price changes as transitory, not warranting a substantial change. That’s critical because we only have a small capacity to adjust our own consumption without significant changes in our equipment and processes. That’s business jargon, but it applies to families, too. Changing processes could mean car-pooling, riding the bus, or corporate use of routing software to reduce miles driven by a delivery fleet. Equipment changes could mean trading in the SUV for a smaller car, or a company replacing aging diesel equipment with modern, fuel efficient equipment. We don’t change processes or equipment without good reason.

That "short-run inelasticity of demand," which means that we don’t change the quantity we use very fast, helps to drive price changes in the short-run. Let’s say that we have one percent less gasoline available for all consumers, but none of us will change our consumption by very much in the short run. Then it takes a whopping big price change to get us to reduce our demand so that it matches available supply.

The result is that we can have very big price hikes while demand seemingly doesn’t react. But give consumers a little time, and they start to react. The chart shows that. The price has probably reacted more in the short-run than it needs to in the long-run. Implication: prices likely to fall in the future.

When are we at greatest vulnerability of high gasoline prices helping to cause a recession? During that period when we are trying to get by without adjusting. We have less money to spend on non-gas goods and services because we’re trying to avoid changes to our processes and equipment. Once we bit the bullet and change, there’s less risk that the high gasoline prices will cause a recession.

Are we out of the woods with respect to a recession? Not yet. Prices are still rising. It’s better than we’re reducing our gasoline demand, but until we see prices start to fall, we’re not out of the recessionary woods.