I keep reading about the credit crunch. Can’t find it myself.

Oh, if you’re a sub-prime person who wants a house with nothing down and no income verification, then credit is not available. But outside of real estate, I can’t find a credit crunch. I’ve been talking to my many banker clients, and they all tell me they are happy making regular old commercial and industrial loans to businesses. Any company that still meets the standards banks were using two years ago will have no trouble getting a bank loan today.

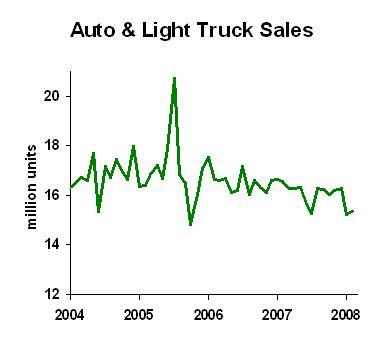

On the consumer side, I don’t see any troubles. There may be fewer people meeting the standards, and some credit card companies are tightening their standards, but the average person with a good FICO can still get credit. A good gauge of that is the car industry. Most cars are sold on credit, and almost all of that credit is securitized in much the same way that mortgages are packaged and resold to investors. You’d think that the market for securitized loans would have dried up, but that’s not the case. A good way to see that is the volume of car sales. There’s certainly a slowdown, but not a collapse. And I think the slowdown is driven by consumer attitudes more than a change in credit availability.

Now for real estate. Sub-prime mortgages are hard to get, and jumbos are much more expensive than they used to be. Developers are having to put up more equity, but under they right conditions, they can still get credit.

My personal experience: I was asked to investigate the possibility of the Willamette Sailing Club, a great small sailboat oriented club in Portland, borrowing a million dollars to build a new clubhouse. I called three local banks, spoke to high-level officers, and found that all three were willing to do the deal. Sure, they wanted an appraisal of our land. They wanted to see financials and membership numbers. But credit is available. Cool. Just wait to you see what we look like next year.