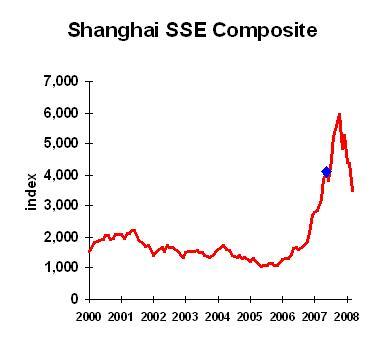

In May 2007, I titled a post, "Is China’s Stock Market Overvalued?" I closed with these words:

"… don’t get carried away with the momentum play. It may work early in

the cycle, but momentum investors always get burned when the market

changes.

Let’s take a look and see what happened. The date of my previous post has a blue marker:

Is the Chinese market

low enough to buy in now? Keep in mind that the market has tripled in three years! That does not strike me as low.

I still like Chinese investments as a diversification play, but I think it’s a fool’s game to go chasing price trends.