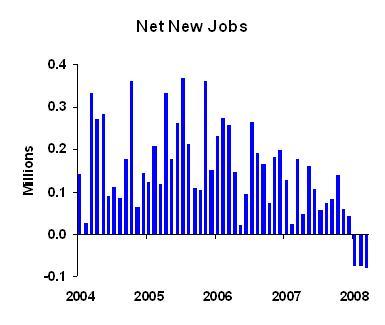

So employment was down again, for the third month:

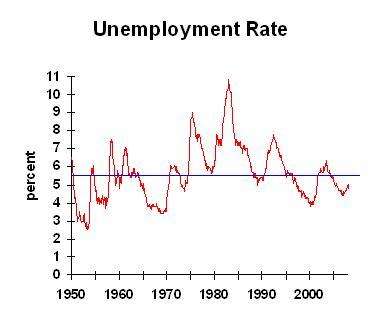

Although the unemployment rate is rising, it’s still below the long-run average. However, unemployment tends to be a lagging indicator; that is, it will hit bottom after the overall economy (measured by production and employment) hits bottom. So we almost certainly have worse news coming.

It’s most likely that this is a recession (and I’ll explain below why I have to say "likely" rather than "definitely.") Not only is the direction of change negative, but the damage is widespread. These major sectors had declines in employment last month:

- Construction

- Manufacturing

- Wholesale trade

- Retail trade

- Transportation services

- Information services

- Financial services

- Professional and business services

So that’s the bad news. Now for some–no, it’s not good news, let’s just call it perspective. The magnitude of the employment decline is pretty small: less than 2/10s of one percent from the peak in December through March. So don’t think of massive layoffs; think of minor adjustment. (I know that to people who have lost their jobs, it feels pretty massive. Sorry, but I’m looking at an economy with 300 million people living in it.)

Some sectors have rising employment: high tech manufacturing, health care, restaurants.

The Wall Street Journal was more inane than usual. They noted the 80,000 decline in jobs and said, "Had it not been for a rise in government jobs last month, payrolls would have fallen by around 100,000." Let me add that had it not been for the drop in construction employment, payrolls would only have fallen by 29,000. Did you learn anything from this? I didn’t think so.

How should business plans be adjusted now? Now that you’ve looked at the forest, spend more time with your trees. Look at your own sales, by segment and geography. If you sell to other businesses, watch your customers’ sales closely. There’s plenty of variety of there; you need to know whether you are in the happy side of the economy (and there certainly is one) or the sad side. This might be a good time to listen to my Economic Contingency Planning CD.

Final note: why is this "likely" a recession instead of definitely a recession? Next month we could (not likely, but possible) see an expansion of employment, followed by nothing but expansion for the rest of the year. If that happens, then we’ll look at these three months of decline and say "blip" rather than "recession." So anyone who says that we are definitely in a recession now is making a forecast about the next few months. He is probably right, but he’s making a forecast, not reading hard data.