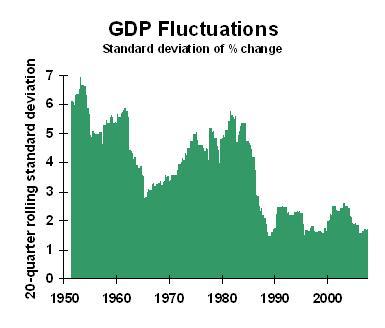

Yesterday I posed the question of why the mortgage mess happened, and why at the time that it did. There were two fundamental building blocks of the crisis: the Great Moderation and Securitization. The aftermath of the 2001 recession provided the trigger for the mortgage mess. In this post, I explain the role of The Great Moderation.

The

Great Moderation is the new world of macroeconomic cycles that began in

1983. In the United States and around

the world, recessions became milder and less frequent. (There’s a great interview with Mark Thoma

about this topic in the Businomics Audio Magazine.) The chart of rolling 20-quarter standard deviation of real GDP changes illustrates the calming of the economy:

Back in

1983, a business executive with 25 years of experience would have experienced

five full business cycles. Today, an

executive with a quarter-century of experience has only gone through two full

cycles. We are less experienced in

dealing with recessions because of the Great Moderation.

The

Great Moderation by itself lowered fears of recession, but the nature of the

most recent recession (not counting the current cycle) also reduced concerns

about a possible downturn in housing values. The 2001 recession was triggered

by a decline in business capital spending, especially in high tech and

communications. Housing suffered

relatively little; it was the mildest housing cycle of the postwar recessions.

As a

result of the Great Moderation and the strength of housing in the 2001

recession, the housing sector appeared to be recession-proof. This was a mistake, and those of us who like

to examine long data series knew it, but financial types prefer to look at

recent data. When I attended my first

Credit Policy Committee meeting as a bank economist, back in 1988, the

experienced lenders priced consumer loans based on a five-year average loss

rate. I was thunderstruck! The

five-year period did not go far enough back to include a recession. In fact, credit policy coming out of a

severe recession tends to be tight, so we were probably looking at abnormally

good credit history. This is the kind

of stuff that financial people should do a better job at.

Next:

the role of securitization in the mortgage mess.