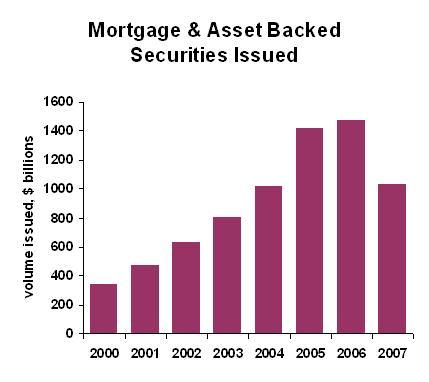

Previously, I posed the question of why the crisis emerged when it did, then I explained the role of the Great Moderation. Now I talk about how securitization formed a building block of the crisis.

The

second factor enabling the mortgage mess was securitization. The first

securitized mortgage transaction took place in February 1970, but primitive

computers were not up to the many flavors of securitization that would

eventually arrive. As the housing market boomed, securitization took off.

Securitization

had some affects that helped form the mortgage mess. One was the growth of mortgage brokers. At first, the traditional lenders–savings and loans plus some

banks–used securitization to help their balance sheets. It was a great move. No institution funded with deposits of five

year maturity or less should hold 30-year loans.

Independent

mortgage brokers, who could help consumers shop around for the best deals, came

to dominate the industry. This business

model came to dominate partly because consumers liked the idea of working with

someone beholden to no one institution, and partly because the most successive

(aggressive?) mortgage personnel gravitated to independent shops, where their

compensation was totally on commission. The independent mortgage broker didn’t much care what happened to the

loan once the paperwork was finished and he got his fee. Furthermore, there was no mortgage-lender

gossip ("Gee, we sure are originating a lot of crappy loans this

days.") to rise to the executive suite. The independent mortgage brokers also enabled a more fraudulent environment,

but fraud is not the dominant reason for the current mortgage mess–it’s more a

side dish than the main course of explanation.

Along

with securitization came investors. The

main funders of mortgages used to be lenders. Now they were investors. Investors think differently than lenders. Investors hold a security while it is doing well, selling when

they sense that the prospects for that investment are weaker. They assume liquidity, because that’s what

they are used to. A lender, on the

other hand, makes a loan and assumes he will hold it through thick or

thin. The investor buys a

mortgage-backed security thinking he can pawn it off on a "greater

fool" if need be.

Now to

top it off, mortgage securitization became very, very complex. Think first about a simple example of

financial engineering: stripping Treasury bonds. Each bond has two coupons plus a maturity. A 30-year bond can be decomposed into 60

coupons plus the return of principal. A

bundle of 30-year bonds can be combined into 60 different zero-coupon

securities. No problem.

When

the securities underlying the transaction are not issued by the United States

Treasury, you want to think about credit risk. Some mortgages were guaranteed by Fannie Mae or Freddie Mac, so the

mortgage risk was small. Or was it

zero? Would Congress let these

institutions fail if they guaranteed too many dodgy loans? Maybe yes, maybe no. An interesting issue. Other mortgage-backed securities had private

guarantees. Nice–if the guarantor

would survive a housing downturn. In a

mortgage pool with multiple investors, who takes on the credit risk? It can be spread evenly among the owners,

but that’s boring. More interesting is

to create some low-risk segments, and some middling-risk segments, and some

high-risk segments.

This is

far from complicated enough, however. Let’s add prepayments to the broth. When you buy a mortgage-backed security, is it backed by mortgages that

may be refinanced in two years, or may stay on the books for the full 30 year

term. That depends on interest rates,

but not just on the level of interest rates. Refinancing is "path dependent," meaning that refinancing volume

will be different at "seven percent down from nine" as opposed to

"seven percent up from five." You really have to run a thousand possible interest rate paths in a

Monte Carlo simulation to understand prepayments.

So far

we’re only thinking first mortgages. We

could also securitize seconds. The

value of a second mortgage depends on all the things we’ve discussed before, as

well as on the characteristics of the first mortgage.

Now the

securities get interesting. The basic

mortgage-backed securities include different tranches. (One tranche might get the first 12

principal payments to come in, making it very safe. Another tranche might get some of the later payments, making it

very risky.) Tranches from different

mortgage pools can be combined into Collateralized Mortgage Obligations

(CMOs). There are even CMOs comprised

of CMOs, like a fund of funds.

All of

this becomes very confusing and hard to analyze. The investors didn’t really know what they were buying in many

cases. They fell back (as we all do) on

a few shorthand numbers, such as estimated duration (weighted-average maturity)

and credit grade. The fact that both of

these concepts were just wild guesses for complex CMOs was lost on the

investors.

We have

the Great Moderation and a very mild last housing cycle, coinciding with the

development of securitization. Next

we’ll see how the last recession sowed the seeds for the current mortgage mess.