I'll be updating my economic forecast in early August, taking a little longer than usual because of a major revision in the GDP statistics and their underlying components. (Data wonks read this.) However, it's never too soon to think about the strengths and weaknesses of the recovery. Before getting into that, though, let's look at a chart that comes courtesy of David Altig of Macroblog:

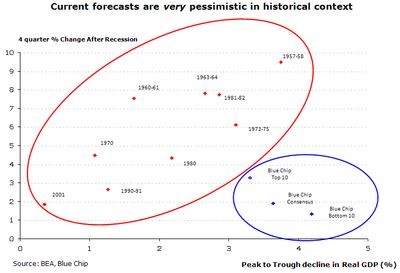

It took me a minute to figure it out. The horizontal axis of the chart shows the depth of the recession. The vertical axis shows the strength of the recovery. The points within the red circle are historic data for past recessions. The points within the blue circle are predicted values from the Blue Chip Economic Indicators survey.

Look at how this historical data tend to fit along an upward-sloping trend. Because the two axes use different scales, it may not be apparent that the line of best fit is pretty steep. By eyeball, recessions with a two percentage point drop in GDP are usually followed by a six percent gain in GDP.

Now look at the Blue Chip consensus. Even the most optimistic forecasters are much more pessimistic than historical experience. (But that's OK–it's quite possible that we will expand the envelope of historical experience here.)

For the record, my current (meaning old) forecast has 2.8% growth of GDP in the four quarters that begin the recovery, so I'm more optimistic than average, but less optimistic than the 10 biggest optimists. I'm also more pessimistic than historic average experience.

Now let's do the conceptual tally:

Factors leading to an economic recovery:

The high savings rate has put money into consumers' pockets

Monetary stimulus has been very strong

Inventories will swing from negative to positive forces

The weak sectors, such as housing construction, can't get much worse

Factors that will limit the strength of the recovery:

The residential construction sector will not rebound, because of excess supply

Consumers will be moderate in their spending rebound

Credit limitations will limit some business and consumer spending

Uncertainty about government policy will trigger delays in spending decisions

How will tax hikes and the deficit affect the economy?

Tax hikes will have negative effects in the short run, but my reading of economic history is that they do not trash the economy in the short run. They will limit our growth by a bit, which will accumulate like compound interest (but with a negative effect rather than a positive effect) over time. I don't expect the deficit per se to have a big effect, except that it will trigger tax increases.

Will inflation accelerate in 2010?

There will certainly be some inflation acceleration in my economic forecast, but nothing like the early 1980s. That's because I think the Federal Reserve will begin tightening next year. But keep your fingers crossed.

Question for readers: What other items should I report to you when I complete my forecast? Leave a comment.